Tax Brackets Netherlands 2019 . the netherlands taxes its residents on their worldwide income; dutch tax rates 2019. the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. Income calculator, income tax return, wage tax, gross salary, tax. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. Premiums for the national insurances are due by the employer and are part of the wage tax rate. 11 february 2019 add expertise tag add service tag add country tag. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. information about the dutch tax system in the netherlands.

from www.smartfinancialplanning.com

11 february 2019 add expertise tag add service tag add country tag. the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. information about the dutch tax system in the netherlands. Premiums for the national insurances are due by the employer and are part of the wage tax rate. Income calculator, income tax return, wage tax, gross salary, tax. dutch tax rates 2019. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. the netherlands taxes its residents on their worldwide income;

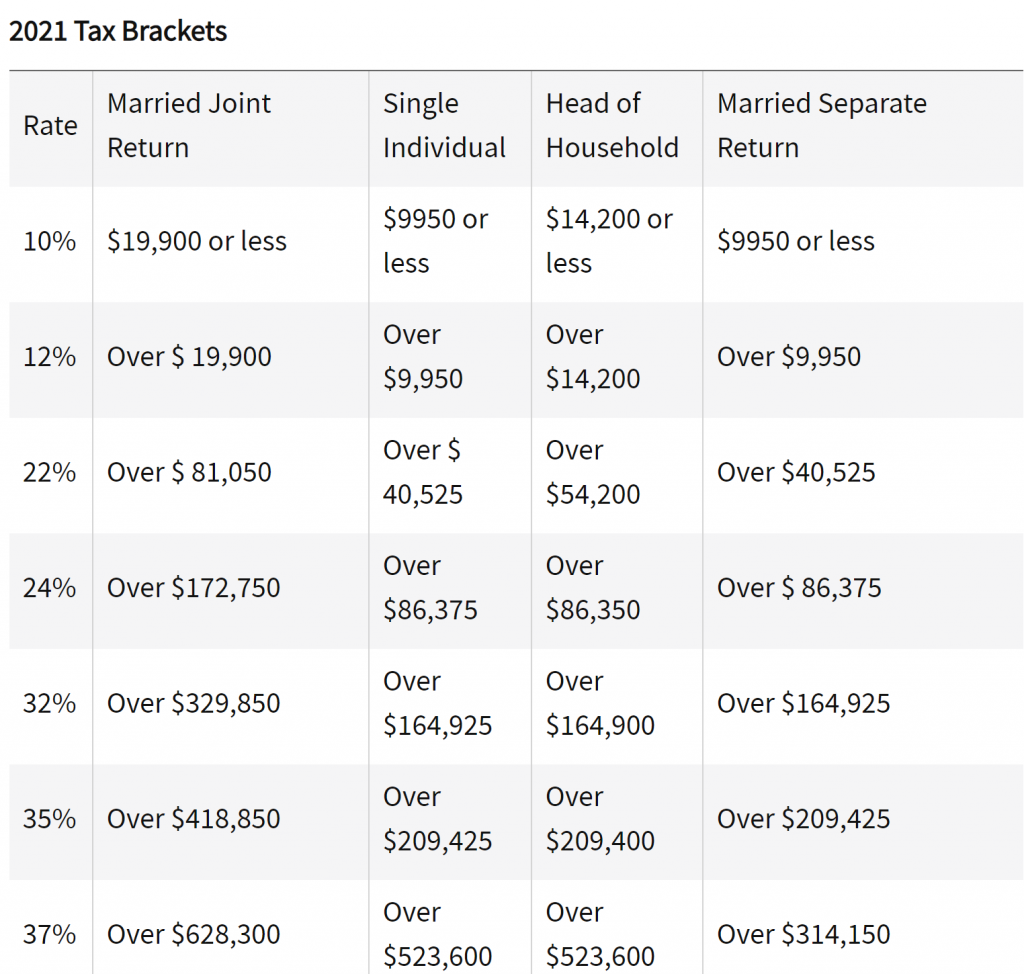

New Tax Brackets, Medicare and S.S. info Retirement Planning

Tax Brackets Netherlands 2019 Premiums for the national insurances are due by the employer and are part of the wage tax rate. the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. information about the dutch tax system in the netherlands. dutch tax rates 2019. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. Income calculator, income tax return, wage tax, gross salary, tax. Premiums for the national insurances are due by the employer and are part of the wage tax rate. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. 11 february 2019 add expertise tag add service tag add country tag. the netherlands taxes its residents on their worldwide income;

From sarahhart.pages.dev

Tax Brackets 2025 South Africa Sarah Hart Tax Brackets Netherlands 2019 dutch tax rates 2019. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. Income calculator, income tax return, wage tax, gross salary, tax. 11 february 2019 add expertise tag add service. Tax Brackets Netherlands 2019.

From jacquelinejackson.pages.dev

Tax Brackets 2025 Ireland Jacqueline Jackson Tax Brackets Netherlands 2019 the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. information about the dutch tax system in the netherlands. Income calculator, income tax return, wage tax, gross salary, tax. Premiums for. Tax Brackets Netherlands 2019.

From winningsilope.weebly.com

Tax brackets 2019 winningsilope Tax Brackets Netherlands 2019 Income calculator, income tax return, wage tax, gross salary, tax. the netherlands taxes its residents on their worldwide income; 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. dutch. Tax Brackets Netherlands 2019.

From www.tillerhq.com

2019 Tax Brackets Spreadsheet Tax Brackets Netherlands 2019 the netherlands taxes its residents on their worldwide income; 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. Premiums for the national insurances are due by the employer and are part of the wage tax rate. 11 february 2019 add expertise tag add service tag add country tag. . Tax Brackets Netherlands 2019.

From thehill.com

Tax filers can keep more money in 2023 as IRS shifts brackets Tax Brackets Netherlands 2019 the netherlands taxes its residents on their worldwide income; information about the dutch tax system in the netherlands. Premiums for the national insurances are due by the employer and are part of the wage tax rate. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. 31 rows income. Tax Brackets Netherlands 2019.

From www.pdfprof.com

tax brackets 2019 washington state Tax Brackets Netherlands 2019 information about the dutch tax system in the netherlands. the netherlands taxes its residents on their worldwide income; 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. dutch tax. Tax Brackets Netherlands 2019.

From www.westernstatesfinancial.com

2019 Federal Tax Brackets, Tax Rates & Retirement Plans Western Tax Brackets Netherlands 2019 11 february 2019 add expertise tag add service tag add country tag. Income calculator, income tax return, wage tax, gross salary, tax. the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001.. Tax Brackets Netherlands 2019.

From elsishannah.pages.dev

2024 Tax Brackets Married Filing Separately Single Tessa Michaeline Tax Brackets Netherlands 2019 Premiums for the national insurances are due by the employer and are part of the wage tax rate. 11 february 2019 add expertise tag add service tag add country tag. Income calculator, income tax return, wage tax, gross salary, tax. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. . Tax Brackets Netherlands 2019.

From taxrise.com

How Rising Inflation Can Affect Your Federal Tax Bracket Next Year Tax Brackets Netherlands 2019 the netherlands taxes its residents on their worldwide income; Premiums for the national insurances are due by the employer and are part of the wage tax rate. dutch tax rates 2019. 11 february 2019 add expertise tag add service tag add country tag. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by. Tax Brackets Netherlands 2019.

From ryteicon.weebly.com

Us federal tax brackets for 2019 ryteicon Tax Brackets Netherlands 2019 information about the dutch tax system in the netherlands. dutch tax rates 2019. Premiums for the national insurances are due by the employer and are part of the wage tax rate. the netherlands taxes its residents on their worldwide income; the income tax rates and personal allowances in netherlands are updated annually with new tax tables. Tax Brackets Netherlands 2019.

From sidonniewblair.pages.dev

Standard Deduction Tax Brackets 2024 Candy Corliss Tax Brackets Netherlands 2019 the income tax rates and personal allowances in netherlands are updated annually with new tax tables published for. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. Income calculator, income tax return, wage tax, gross salary, tax. the netherlands taxes its residents on their worldwide income; Premiums for. Tax Brackets Netherlands 2019.

From lorrainekaiser.pages.dev

Tax Brackets For Married Filing Jointly 2025 Lorrai Nekaiser Tax Brackets Netherlands 2019 the netherlands taxes its residents on their worldwide income; dutch tax rates 2019. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. information about the dutch tax system in the netherlands. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet. Tax Brackets Netherlands 2019.

From taxfoundation.org

2019 State Individual Tax Rates and Brackets Tax Foundation Tax Brackets Netherlands 2019 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. Premiums for the national insurances are due by the employer and are part of the wage tax rate. 11 february 2019 add expertise tag add service tag add country tag. dutch tax rates 2019. Income calculator, income tax return, wage. Tax Brackets Netherlands 2019.

From lacyyodella.pages.dev

Tax Brackets 2024 Sars Gerty Juliann Tax Brackets Netherlands 2019 information about the dutch tax system in the netherlands. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. 11 february 2019 add expertise tag add service tag add country tag. dutch tax rates 2019. the netherlands taxes its residents on their worldwide income; review the latest. Tax Brackets Netherlands 2019.

From isaacbutler.pages.dev

Tax Brackets 2025 South Africa Calculator Isaac Butler Tax Brackets Netherlands 2019 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. Premiums for the national insurances are due by the employer and are part of the wage tax rate. dutch tax rates 2019.. Tax Brackets Netherlands 2019.

From gennieseline.pages.dev

Tax Brackets 2024 Calculator Jeri Rodina Tax Brackets Netherlands 2019 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. Premiums for the national insurances are due by the employer and are part of the wage tax rate. 11 february 2019 add expertise tag add service tag add country tag. Income calculator, income tax return, wage tax, gross salary, tax. . Tax Brackets Netherlands 2019.

From www.companyformationnetherlands.com

Tax Brackets in the Netherlands Tax Brackets Netherlands 2019 dutch tax rates 2019. information about the dutch tax system in the netherlands. 11 february 2019 add expertise tag add service tag add country tag. Premiums for the national insurances are due by the employer and are part of the wage tax rate. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by. Tax Brackets Netherlands 2019.

From brokeasshome.com

Irs Withholding Tax Tables 2019 Tax Brackets Netherlands 2019 Premiums for the national insurances are due by the employer and are part of the wage tax rate. review the latest income tax rates, thresholds and personal allowances in netherlands which are used to calculate. 31 rows income tax in the netherlands (personal, rather than corporate) is regulated by the wet inkomstenbelasting 2001. the netherlands taxes its. Tax Brackets Netherlands 2019.